Presents

Medicare 101: Everything You Need to Know About Medicare!

The U.S. Retirement Education Association is pleased to announce our workshop. You are cordially invited to join us for this special event, where we will discuss crucial topics for individuals approaching the age of 65. It is a complimentary 45-minute informational presentation for the community. This is an event you will not want to miss!

Join us at one of our venues below:

Please scroll down to view all available in person workshop dates and times.

In Person Workshops

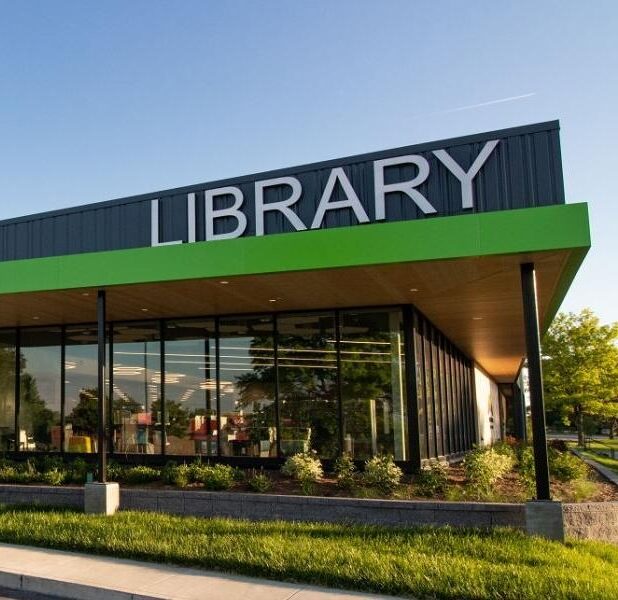

Mid-Continent Public Library – East Lee’s Summit Branch

3/23/2026 6:00 pm

2240 Southeast Blue Parkway, Lee’s Summit, MO, 64063

Mid-Continent Public Library – Woodneath Library Center

3/24/2026 6:00 pm

8900 Northeast Flintlock Rd., Kansas City, MO 64157

Mid-Continent Public Library – Grandview Branch

3/25/2026 6:00 pm

12930 Booth Ln., Grandview, MO, 64030

SIGN UP NOW!

Seats are limited. Register today to guarantee your spot(s)!

If you’re viewing this in the Facebook app, tap the three dots in the top right corner and choose “Open in browser” for the best experience.

Or refresh this page if it’s not loading properly.

What You’ll Learn

Navigating health coverage options as you approach age 65 can feel overwhelming, which is why we’re here to help you feel confident and informed. We offer easy-to-understand, comprehensive tools to guide you through the planning process.

Our educational session provides a 45-minute presentation addressing common questions such as:

- How Medicare Parts A & B work

- What costs are associated with Medicare

- When and how to enroll

- How Medicare interacts with employer coverage

- What to consider when evaluating your healthcare needs in retirement

- Common questions and misconceptions about Medicare

We also explore the types of plans available in your area and what each one includes.

Featured Presenter: Greg Greenwalt

Greg is a resident of Kansas City, Missouri. Prior to entering the insurance industry, Greg worked as a high school biology teacher and piano tuner for 16 years. He was eventually approached to enter the insurance sales field and educate families on life insurance and how it could be used to assist in accumulating funds for college, retirement, and mortgage acceleration. After about a few years, Greg branched out into other products in succession until he was fully conversant on each. His entire approach was to share ideas with clients on how they could properly manage their money for accumulation, protection of assets, income protection, health insurance, cancer coverage, and long-term care policies. Today Greg’s practice consists primarily of annuity and life insurance sales along with Medicare products. His focus hasn’t changed substantially his entire 34+ years in the business, which is to help people live a financially secure lifestyle. Greg plans to continue working as an independent agent as long as he is physically able.

We do not offer every plan available in your area. Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program (SHIP) to get information on all of your options.

Workshops provided by U.S. Retirement Education Association.

This event is hosted by a 501(c)(3) nonprofit organization and is intended solely for educational purposes. It is not a sales presentation. No insurance products will be marketed or sold. The presenter is not affiliated with Medicare, CMS, or any government agency.

Any personal information collected will be used only to confirm attendance and provide educational materials. It will not be used for marketing or shared with third parties.